All Categories

Featured

Table of Contents

Removing representative settlement on indexed annuities permits for significantly greater detailed and real cap prices (though still substantially lower than the cap rates for IUL policies), and no doubt a no-commission IUL plan would press detailed and real cap prices higher. As an aside, it is still possible to have an agreement that is extremely rich in agent payment have high early cash abandonment worths.

I will certainly acknowledge that it is at the very least in theory feasible that there is an IUL policy around issued 15 or two decades ago that has provided returns that are exceptional to WL or UL returns (much more on this below), however it is necessary to better understand what an ideal comparison would entail.

These policies typically have one lever that can be evaluated the firm's discretion annually either there is a cap price that specifies the optimum crediting price because specific year or there is a participation rate that defines what percentage of any positive gain in the index will certainly be passed along to the plan because particular year.

And while I generally agree with that characterization based upon the mechanics of the plan, where I differ with IUL supporters is when they define IUL as having premium go back to WL - life insurance term vs universal. Lots of IUL supporters take it an action additionally and indicate "historic" information that appears to sustain their cases

Initially, there are IUL policies around that lug more danger, and based on risk/reward concepts, those policies must have greater anticipated and actual returns. (Whether they actually do is an issue for serious dispute yet companies are utilizing this approach to aid validate higher detailed returns.) Some IUL plans "double down" on the hedging technique and assess an additional charge on the plan each year; this charge is then made use of to enhance the alternatives spending plan; and then in a year when there is a favorable market return, the returns are intensified.

Iul Investment Calculator

Consider this: It is possible (and as a matter of fact likely) for an IUL policy that standards an attributed rate of say 6% over its very first 10 years to still have a total negative rate of return during that time because of high charges. Several times, I discover that agents or consumers that boast concerning the performance of their IUL plans are confusing the attributed price of return with a return that appropriately mirrors all of the policy charges.

Next we have Manny's question. He says, "My close friend has actually been pressing me to get index life insurance and to join her company. It looks like a Multi level marketing.

Insurance sales people are not bad individuals. I'm not recommending that you would certainly despise on your own if you claimed that. I said I made use of to do it? That's how I have some insight. I made use of to market insurance at the start of my occupation. When they market a costs, it's not uncommon for the insurance policy company to pay them 50%, 80%, also sometimes as high as 100% of your first-year premium.

It's hard to sell since you obtained ta always be looking for the next sale and going to discover the following individual. It's going to be difficult to locate a lot of gratification in that.

Let's discuss equity index annuities. These points are prominent whenever the marketplaces are in a volatile period. But here's the catch on these things. There's, first, they can control your habits. You'll have abandonment durations, commonly 7, ten years, possibly also past that. If you can not get access to your money, I understand they'll tell you you can take a small portion.

Buy Universal Life Insurance

Their surrender durations are significant. That's exactly how they know they can take your cash and go fully spent, and it will be okay since you can not obtain back to your money until, once you're right into seven, 10 years in the future. That's a lengthy term. Regardless of what volatility is going on, they're probably mosting likely to be fine from an efficiency viewpoint.

There is no one-size-fits-all when it revives insurance coverage. Getting your life insurance policy strategy appropriate takes into consideration a number of variables. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, monetary self-reliance can look like an impossible goal. And retired life might not be top of mind, because it appears until now away.

Less companies are providing standard pension strategies and numerous firms have reduced or discontinued their retired life plans and your capability to depend only on social protection is in inquiry. Even if advantages have not been minimized by the time you retire, social security alone was never planned to be adequate to pay for the lifestyle you desire and should have.

Ideal Universal Life

/ wp-end-tag > As part of a sound financial technique, an indexed universal life insurance coverage plan can assist

you take on whatever the future brings. Before devoting to indexed universal life insurance, right here are some pros and cons to consider. If you select an excellent indexed universal life insurance coverage plan, you may see your cash worth expand in worth.

If you can access it early on, it may be beneficial to factor it right into your. Because indexed global life insurance policy needs a certain level of threat, insurance provider have a tendency to keep 6. This kind of strategy additionally supplies. It is still ensured, and you can readjust the face quantity and riders over time7.

Generally, the insurance policy business has a vested rate of interest in executing much better than the index11. These are all elements to be considered when selecting the finest kind of life insurance coverage for you.

However, considering that this kind of policy is a lot more intricate and has an investment part, it can frequently include higher premiums than various other plans like entire life or term life insurance policy. If you do not think indexed global life insurance policy is right for you, right here are some choices to take into consideration: Term life insurance policy is a temporary policy that normally supplies coverage for 10 to thirty years.

Iul Insurance Quotes

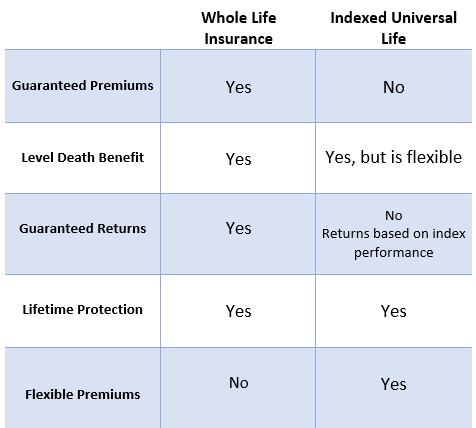

When determining whether indexed global life insurance policy is appropriate for you, it is essential to consider all your options. Whole life insurance coverage may be a far better option if you are looking for more stability and uniformity. On the various other hand, term life insurance policy might be a better fit if you just require insurance coverage for a specific amount of time. Indexed universal life insurance is a type of policy that uses a lot more control and adaptability, along with higher money worth growth potential. While we do not offer indexed global life insurance, we can supply you with more info about whole and term life insurance policy policies. We advise exploring all your alternatives and chatting with an Aflac representative to uncover the finest fit for you and your family members.

The remainder is added to the money worth of the policy after fees are deducted. While IUL insurance policy might show important to some, it's crucial to recognize exactly how it works before purchasing a policy.

Table of Contents

Latest Posts

Difference Between Whole Life And Iul

Index Insurance

Minnesota Life Iul

More

Latest Posts

Difference Between Whole Life And Iul

Index Insurance

Minnesota Life Iul